April 30, 2021

Renovation Home Equity Loans

Provider website: https://www.renofi.com/

What is a Renovation Loan?

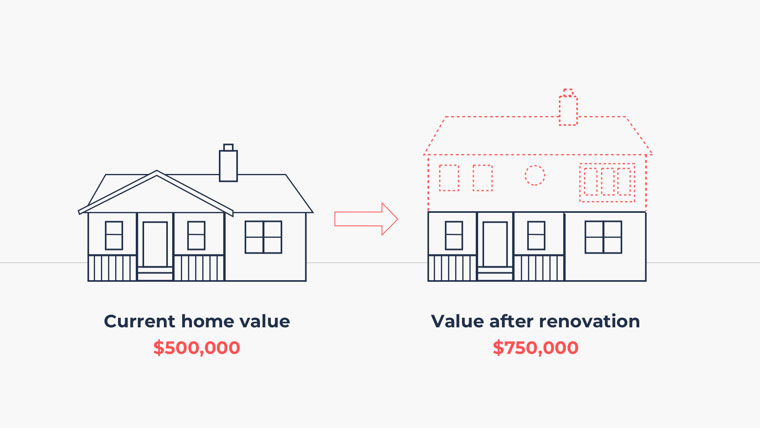

Home Renovation loans allow a home-owner to borrow against the after-renovation value of their home. This loan product doesn’t require you to refinance your current mortgage - this is especially useful if you’ve recently locked in a lower interest rate - rather it functions much like a 2nd mortgage.

Renovation Home Equity Loans is a loan product especially designed for newer homeowners who don’t have a ton of equity in their property but want to leverage their future home’s value to finance a renovation project.

How does this work?

This type of loan product allows you to borrow up to $25k to $500k or up to 90% of the appraised after-renovation value of the home with up to 20 year terms at average market rates. Read more about Renovation Loans on Renofi’s FAQ page.

Pros:

- Does NOT require homeowners to refinance their first mortgage, meaning homeowners can keep their low rates and avoid restarting the clock on their mortgage. Same Low Home Equity rates - for 10 to 20-year terms, rates are typically the same as a traditional home equity loan or line of credit.

- Lower fees - because the loan doesn’t require you to refinance your entire mortgage, you’ll pay less in closing costs because it’s based on a smaller base.

- Can borrow $25k to $500k

- It’s the only renovation loan that doesn’t require homeowners to refinance and it’s the only renovation loan that doesn’t require the funds to be disbursed to the contractor through a messy inspection & draw schedule process.

Cons:

- Because home equity loans typically max out at 20-year terms, the monthly payments for these loans are often a bit higher than payments for other renovation loans with a term of over 30 years.

Construction to Permanent Loans (CTP)

Loan provider website: https://homeconstructionmortgages.com/

What is a Construction to Permanent Loan?

This loan product is ideal for people looking at building their home from the ground up.

According to Bankrate.com, A construction to permanent loan is a loan used to finance the construction of a new home. When the home is complete, it converts into a permanent mortgage loan. Another common term for a construction to permanent loan is a single-close loan.

A unique feature of a construction loan is that it’s like a line of credit. You only draw what you need, and interest is only charged on the amount drawn. Because the lender organization has limited surety, it generally insists on inspecting you and your plans, using an accredited builder.

On completion, the building is inspected for compliance to the plan and to local ordinances. Once the home is completed, a separate mortgage has to be taken out, using the home as collateral.

How does this work?

Construction loans require the money is paid to the contractor, not the homeowner, through a milestone-based disbursement schedule that requires onsite inspections by the bank. Your lender will have to approve the builder you choose. At Home Quality Remodeling, we’ve worked with various lenders in the past so we’re familiar with this process.

It is worth noting that applying for CTP loans typically take longer to close due to the paperwork & vetting procedures involved. While you’re shopping around for financing options, we recommend that you also consider the duration & ease of the application process.

Pros:

- Low monthly payment - Like a traditional mortgage, because you can spread payments over 30 years, your monthly payment is as low as it can be.

- Low rates - Rates are typically in line with the market rate for first mortgages though some lenders can charge a premium.

- Can borrow $1 million+

- Options to convert to a traditional 30 year fixed or specialty loan offerings like Adjustable Rate Mortgages (ARMs)

- Single close means you only sign one set of documents and pay one set of closing costs.

Cons:

- Application process is typically complicated but contact a local CTP loan lender and determine for yourself if the process seems simple enough for you to take on.

- Because you are refinancing, you might be refinancing at a higher rate.

- Because you are refinancing, you have to pay typical closing costs PLUS the extra costs associated with the construction loan, making it one of the most expensive loans on the market from a fees perspective.

- Because you are refinancing, you are starting the clock over on your mortgage which slows down the rate at which you build equity in your home.

Fannie Mae Homestyle Renovation Loans

Loan provider website: https://loans.loandepot.com/203k

What is a Fanny Mae Homestyle Renovation Loan?

According to Renofi, A Fannie Mae HomeStyle loan is a government-sponsored product that lets you finance the purchase (or refinance) and renovation of a property into a single loan.

As opposed to taking out a traditional mortgage and using another loan to pay for renovations, it’s a type of home renovation loan that combines the funds you need to buy and renovate into one loan. This means that borrowers will face just one set of closing costs and have just one monthly payment to make.

These loans can also be used to refinance and pay for a remodel on an existing property. They come as either 15 or 30 year fixed-rate mortgages or adjustable-rate mortgages that have a minimum down payment requirement of 5% of the combined cost of the property plus repairs (although a 97% LTV may be available to first time homebuyers).

How does this work?

Whether being used to buy and repair a fixer-upper or to refinance your current home to pay for renovations, here’s how this type of loan works:

- Find a fixer-upper for sale that needs renovation repairs or decide to renovate your home by borrowing against its after renovation value

- Find a Fannie Mae-approved lender and apply for the loan.

- Work with an approved contractor and/or architect to draw up and finalize your plans and prepare a detailed bid for the renovations. A copy of these must then be supplied to the lender.

(Your lender will send all estimates to a HUD consultant, they perform a specification of repairs, which is an evaluation of the estimate to make sure that you’re being charged the right amount of money for the renovation by the contractor.)

- The lender will then perform an appraisal based upon the after renovated value of the property.

- Close on the loan.

- After the loan closes, the lender will place the renovation funds in an escrow account. If your renovation amounts are greater than $35,000, or structural in nature, a HUD consultant must be hired to authorize the release of the funds. The funds can only be released after a progress inspection from the HUD consultant.

- Your renovation must begin within 30 days of the loan closing and must be completed within a six month period. Your contractor will be paid according to the draw schedule and following inspections.

- The lender manages draws based upon these inspections (intervals at which contractors can request funds). These inspections are carried out to determine where a project is in relation to the proposed timeline, and that the construction work matches the initial plan and is completed in a workmanlike manner. Then when renovation work is completed, the lender will conduct a final inspection to check that the project has been undertaken to the original specification and release the final funds to your contractor.

It’s important to remember that steps one through five must be completed before you can close on the property if you’re using the loan to purchase your home. If you live in the Bay Area where the housing market is extremely competitive, your selling might not stick around to wait for this process to run its course. That being said, this financing option is ideal if time isn’t a constraint. The reality is that the process is complex and confusing, and delays during this are common

What can you use Fannie Mae Homestyle loans for?

Just some of the renovation projects that could be financed with a HomeStyle include:

- Full house remodel

- Kitchen remodel

- Bathroom remodel

- Swimming pool addition

- Tennis court addition

- Barbecue area addition

- Financing an ADU (See additional qualifications)

- Landscaping

- Basement finishing

It’s important to note that these loans cannot be used to tear down and reconstruct a home, nor can structural additions add another unit to the property (e.g. they cannot be used to turn a single unit property into a two unit one).

Read more about Fannie Mae HomeStyle loans on Renofi’s website or the Fannie Mae website.

Pros:

- Low down payments of 5% or required equity position.

- Can be used on a second home, vacation home or investment property as well as single family homes, meaning they’re available to investors as well as homebuyers. In comparison, an FHA 203k can only be used for a primary residence.

- Can be used to finance most renovation projects, including luxury amenities such as the addition of a swimming pool, a tennis court, a barbeque area or similar.

- Homebuyers can consider fixer-uppers they could otherwise not afford to renovate.

- A lower credit score requirement than private bank alternatives (yet higher than for an FHA 203k).

Cons:

- Additional steps compared to alternatives that can cause delays in the process. These loans typically take longer to close than traditional mortgages..

- Your renovation must be overseen by an HUD consultant if the loan amount is over $35,000 or structural in nature, adding more work and extra complexity when compared with alternative ways of financing.

- The interest rate is normally higher than most alternatives (including home equity loans and lines of credit, cash-out refinance or RenoFi Loans)..

- Higher fees and closing costs than other types of financing.

- If used to pay for renovations on your current home, you will need to refinance your parent mortgage, often at a higher rate. This also slows down the rate at which you build equity.

- You’re on a timeline and only have six months to complete renovation work.

FHA 203K loans

Loan provider website: https://homeconstructionmortgages.com/

What is a Fanny Mae Homestyle Renovation Loan?

An FHA 203k loan allows you to finance both the cost of purchasing a property plus the cost of repairs in a single loan.

It’s a government-backed mortgage (by the Federal Housing Administration) that is essentially a construction loan and is primarily intended to encourage homeownership amongst lower-income families (or those with a lower credit score) and to support the renovation of older properties and fixer-uppers as a primary residence.

These loans can be used to refinance and pay for a remodel on an existing property or to purchase and renovate a fixer-upper. They come as either 15 or 30 year fixed-rate mortgages or adjustable-rate mortgages that require a minimum down payment of 3.5% of the combined cost of the property plus repairs.

The FHA does not lend the money on 203k loans, rather they provide financial protection to approved lenders.

Standard 203k Rehab Loan vs Limited 203k Mortgage

There are two types of FHA 203k loans: the Standard 203k Renovation Loan (Rehab Loan) and the Limited 203k Renovation Loan (Mortgage), which used to be known as the ‘Streamline 203k.’ They each have their own requirements, allowable projects and borrowing limits.

The Limited 203k renovation loan is only suited to minor repairs and home improvements (they do not permit structural repairs and have a maximum renovation budget and cost equalling $35,000 or less), however, and this means that most homeowners who are either purchasing and renovating or refinancing and renovating will be considering the Standard 203k renovation loan. Limited 203ks don’t require a HUD consultant to be appointed.

How much can you borrow with an FHA 203K loan?

FHA 203k Rehab loans let you borrow based upon 96.5% of the after renovation value on a purchase, and 97.5% on a refinance, so long as this is within the local FHA loan limits.

This means that that the maximum you will be able to borrow is the lower of:

- The maximum FHA mortgage limit for the area where the property is located.

- 96.5% of the home’s after renovation value if it is a purchase, and 97.5% if it’s a refinance, including the cost of the renovation.

These loans let you borrow against what your home will be worth after work has been completed and significantly increase your renovation borrowing power compared with traditional home equity loans, lines of credit or a cash-out refinance.

You’ll also be expected to keep a contingency reserve of between 10% and 20% of the renovation bid price, just in case the project goes over budget. This contingency reserve can be financed into the loan amount or paid through personal funds.

These loans let you borrow against what your home will be worth after work has been completed and significantly increase your renovation borrowing power compared with traditional home equity loans, lines of credit or a cash-out refinance.

You’ll also be expected to keep a contingency reserve of between 10% and 20% of the renovation bid price, just in case the project goes over budget. This contingency reserve can be financed into the loan amount or paid through personal funds.

How does this work?

In some ways, the process for taking out and using an FHA 203k loan is similar to the process of buying a home with a traditional mortgage, but these loans have some distinct differences and complexities that you’ll need to know about when considering it as a way to finance a renovation.

These loans can also be used while refinancing a home you’ve already purchased, so we’ll talk about the process for either scenario.

- Find a home to purchase or refinance your existing property: You find a home that you want to buy, but you want to make renovation repairs, or you decide that you want to renovate your existing home and borrow based on your home’s after renovation value.

- Find an FHA 203k lender: Next, you’ll need to find an approved FHA lender and apply for a 203k loan. Your application will need to be approved based on the cost of renovations and the price to purchase (or refinance) the property, along with applicable renovation fees and contingency reserves.

- Find a contractor/builder: You’ll need to find a general contractor who will need to prepare a detailed bid for renovations. A copy will then be provided to the lender.

- Get an “As-Completed” Appraisal: An appraisal is performed on the property to determine the home’s current and after renovation value.

- Lender submits documents to underwriter: The lender submits the bid, appraisal and other required information to the loan underwriter.

- Close on your FHA 203k loan: Once the loan is approved, you are able to go to settlement if you’re purchasing the home. You’ll sign closing documents at this stage.

- Proceeds of the loan are used to purchase the home: The loan funds go to the seller of the property (or to your previous mortgage lender if refinancing) and the renovation and repair funds go into an escrow account.

- Use loan to fund renovation: Renovation work must begin within 30 days and must be completed within six months. The lender will pay the contractor from the escrow account based upon the agreed schedule, which includes draws and inspections.

It’s important to note that steps 1-6 need to happen before you can close on the property if you’re purchasing the home.

Learn more about FHA 203K loans on the Renofi website or the Investopedia website.