A few things we've put together to help you out

Partners & vendors

Countertop, tile, and masonry vendor

Nancy Sanchez

Visit their website here

408 393 6674

6591 Sierra Lane, Dublin

They are experts in helping you pick out the best masonry products to fit your home's aesthetic. Nancy is super knowledgeable and knows to give you our contractor pricing if you're a customer of Home Quality Remodeling.

Kitchen & home appliance vendor

Kwam Mills

Visit their website here

707 208 1944

2304 Monument Blvd, Pleasant Hill

Kwam and the folks at Friedmans have been longtime partners with our clients at HQR. They specialize in helping you outfit your kitchen with high-end kitchen appliances.

Luxury Flooring

Eugene Perez

Visit their website here

650 305 1099

905 El Camino Real, Menlo Park, CA

Euguene and the folks at Menlo Flooring can help you design and pick out flooring for your space.

Mold & water damage remediation

Afik Shibam

Visit their website here

925 708 9489

815 Arnold Dr #2, Martinez, CA 94553

A2Z has been remediating homes in the Bay Area since 2015 and has a fantastic reputation in the industry for their honesty and great customer service.

Natural stone slabs & countertops

Aveli Salundi

Visit their website here

510 203 4447

21050 Forbes Avenue, Hayward

Aveli is our point of contact from Vadara. They have showrooms in Hayward and Berkeley where they display the products they have for sale. Through Home Quality Remodeling, you can get 5% - 15% off on their products. Ask your project manager for more details.

Plumbing repair & installation

Aaron Petrosian

Visit their website here

925 676 6969

Aaron & his dad run Complete plumbing and we're sure you'll be more than happy working with them. They're lovely people & fanstastic plumbers.

Tile, natural stone, counter tops, flooring, & cabinets

Metin Aydin

Visit their website here

925 825 5757

5757 Pacheco Blvd, Pacheco, CA

Metin and the folks at Modello sell a variety of masonry products, flooring, and cabinets. Through Home Quality Remodeling's account, we can get 10% - 20% off on their products.

Planning & design

Preparing Your Home for Remodeling: What You Need to Know Before Starting

Remodeling your home is an exciting project that can transform your living space and add value to your property. However, it's important to be well-prepared before starting any renovation work. In this article, we'll outline what you need to know before embarking on your home renovation journey.

Choosing the Right Kitchen Lighting

There are a few things to keep in mind when choosing kitchen lighting. The first is the size of the room. If the room is small, you'll want to choose light fixtures that don't take up a lot of space. The second thing to consider is the style of your kitchen.

Second Floor Laundry Pros and Cons

Having a laundry room on your home's second floor has pros and cons. On the plus side, you don't have to lug your dirty clothes downstairs whenever you want to wash them. But on the downside, if your washer or dryer breaks, you'll have to schlep everything up and down again.

Home Additions: Worth it or not?

Adding on to your home is a big decision. It can be expensive and time-consuming, but it can also add value to your home and make it more comfortable for your family. So, is a home addition worth it?

Understanding the Cost of Remodeling a Home

The cost of remodeling a 2000-square-foot home can range from $200,000 to $300,000.

The Value of a Kitchen Remodel

Renovating any part of your home is an exciting endeavor and can be rewarding both financially and emotionally.

4 things to consider when removing a wall for a remodel

Understand what it means to remove a wall in your home and get cheaper alternatives to removing a wall.

4 bathroom remodel ideas to raise property value

Here are 4 things to do and 4 things not to do when you're remodeling to raise your property's value.

4 things to know when you’re planning to remodel your bathroom

Find out how to compare bids, get building permits, make warranty claims, and 3 tips on how to save money on your bathroom remodel.

Planning for a second story addition in the Bay Area

Our in-depth perspective on building 2nd story additions onto homes in the Bay Area. If you're planning for a 2nd story addition, this article will help you out.

Remodeling Ideas for Homes in the Bay Area

Check out pictures of other homes and get our top 5 tips when remodeling your home in the Bay Area.

6 questions you need answered when remodeling your bathroom in Santa Clara County

Bathroom remodels are typically the simplest room to remodel. Keeping things simple comes down to choosing the right remodeler who can navigate the local permitting department, coordinate material deliveries, and coordinate specialist contractors.

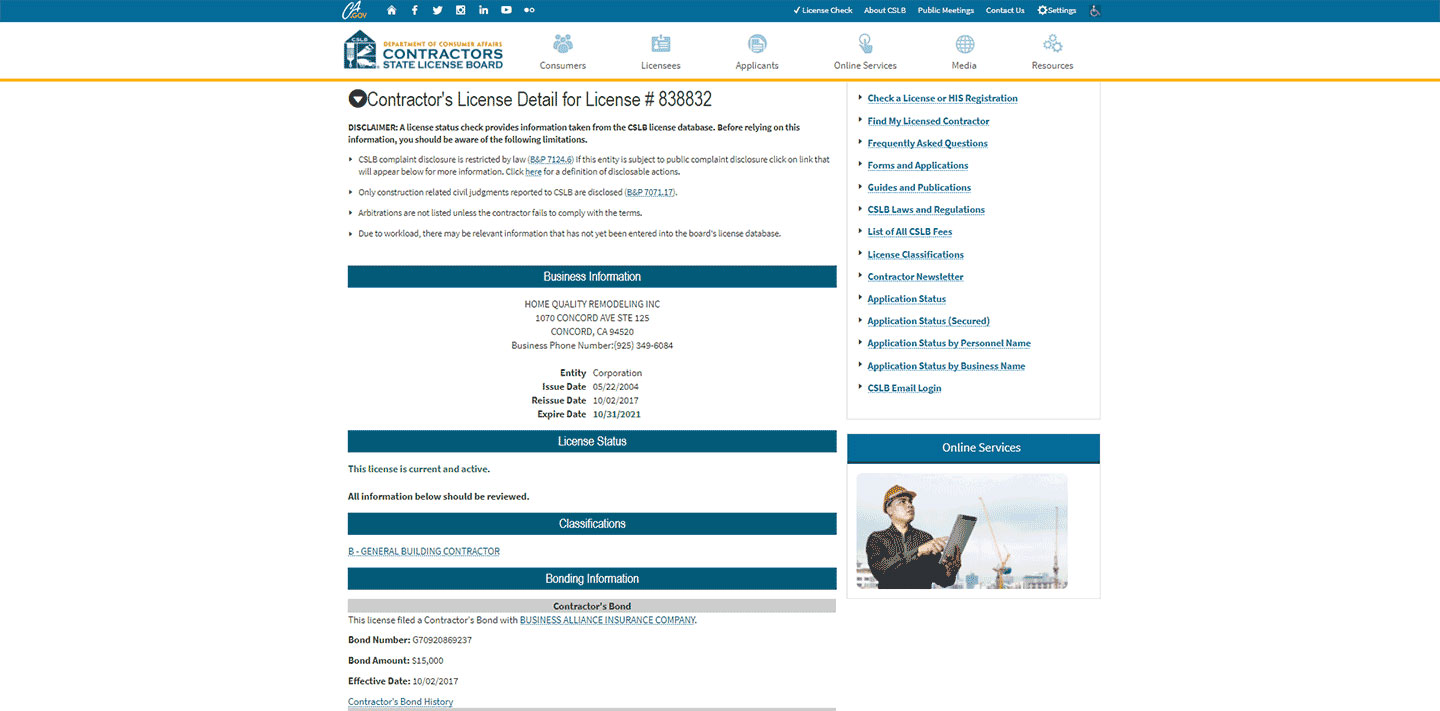

How to check if your contractor is licensed and insured in the Bay Area, California

With a growing number of unlicensed contractors in California, how do you know if your contractor is licensed and insured to cover damages to you or your property?

We've streamlined kitchen remodeling for homes in San Jose

If you’ve thought about remodeling your kitchen for your property in San Jose but don’t have the time to get plans drawn up and approved by the city or collect bids from numerous contractors, consider our comprehensive design and build services at Home Quality Remodeling.

7 things to know when looking for an ADU builder in San Jose, California

With rents for a studio in San Jose going upwards of $2,500 a month, building an ADU can be a great financial investment. With the financial incentives available to Santa Clara residents we go over in this article, building an ADU is totally within your reach.

Codes & permits

Understanding Code and Regulations when Remodeling

Are you planning to remodel your home? If so, you may need to obtain a permit from your local municipality. Depending on the scope of work, you may also need to comply with specific building codes required by your city.

Construction

DIY Vs. Contractor: When to Hire a Professional for Your Home Remodel

Deciding between DIY and hiring a pro for your remodel? Find out when to tackle a project yourself and when expert help ensures safety and quality.

Essential Questions To Ask Before Starting A Home Remodel

Planning a home remodel? Ask these key questions to set a budget, choose the right design, and avoid costly mistakes for stress-free renovation.

Home Renovation Tips for Finding the Right General Contractor

Looking to renovate your home? Discover essential tips for finding the perfect general contractor to ensure a successful and stress-free project.

What You Need to Know When Hiring a Remodeling Contractor

Hiring a remodeling contractor can be a daunting task. Learn what you need to know to make the process easier and ensure a successful renovation.

6 Tips For Hiring A Bathroom Remodeling Contractor

Hiring a bathroom remodeling contractor can be a daunting task, but it's important to take the time to find the right one for your project.

Top 10 kitchen remodeling trends for the year

Looking to remodel your kitchen this year? Check out our list of the top 10 kitchen remodeling trends for 2023.

A Guide to Planning a Successful Bathroom Remodel with Home Quality Remodeling

Discover the essential steps for planning a successful bathroom remodel with Home Quality Remodeling. Get the bathroom of your dreams today!

How to Maximize Your Kitchen Space with a Remodeling Company

Maximizing your kitchen space with a Walnut Creek remodeling company like Home Quality Remodeling can improve the functionality, flow, and beauty of your kitchen.

Why You Should Consider Hiring a General Contractor for Your Home Remodel?

When it comes to home renovation projects, hiring a general contractor can make all the difference in ensuring a successful and stress-free process.

Renovate to Elevate: Transforming Your Home with Remodeling

Are you tired of your outdated home? Does your living space no longer meet your needs? If so, it may be time for a home renovation. Remodeling your home is an exciting way to transform it into a functional and beautiful space that meets your current lifestyle. In this article, we'll explore the benefits of home remodeling and offer tips to help you transform your home into a stunning oasis.

Bathroom renovations: how to maximize their value

Bathroom renovations can provide significant value to your home, both in terms of functionality and aesthetics. By planning your budget, maximizing space, choosing quality materials, focusing on functionality, and working with a professional, you can maximize the value of your investment. At Home Quality Remodeling, we're committed to helping our clients create the bathroom of their dreams. Contact us today to learn more about how we can help you maximize the value of your bathroom renovation.

What To Know About Hiring a kitchen remodeling companies in Walnut Creek

Hiring a kitchen remodeling company in Walnut Creek is an importantdecision that requires careful consideration. You want to work with a companythat has experience, communicates effectively, uses high-quality materials andworkmanship, and is committed to completing your project on time and withinyour budget.

Home Remodeling in Danville: 5 Tips to Know

Home remodeling in Danville can be an exciting and rewarding experience, but it requires careful planning and execution. By following these 5 tips and working with aprofessional remodeling company like Home Quality Remodeling, you can achieve your remodeling goals and transform your home into the one you've always wanted.

Why You Should Work With a General Contractor For Your Renovations

Renovating your home is a significant investment, and it's essential to make the process as smooth and stress-free as possible. A general contractor (GC) can help you achieve this by overseeing all aspects of your renovation project.

Raise your property value with these 2 tips

Raise your property value by working on these 2 areas of your home: the kitchen & your entry way.

Types of ADUs you can build in Danville, CA

Learn more about Danville's free pre-approved ADU plans and the best way to finance the construction of your ADU in Danville, CA.

4 Things to Consider When Remodeling Your Garage in San Jose

Need a space for your in-laws or another room to rent out? If you're located in San Jose, a garage conversion is a great way to achieve these goals. With average rents for a studio reaching $2,500 or more, financing your garage conversion nowadays can be a very wise financial move!

8 things to know when building a home addition in Walnut Creek, California

Building an addition is a great way to add value to your current property. We'll cover a few ways to finance building an addition to your property in Walnut Creek and talk about the City of Walnut Creek's Building Permitting department.